Understanding Macrotrends

- drfabiogiacometti

- Jun 17, 2025

- 2 min read

Macrotrends are long-term, global shifts that influence economies, markets, industries, and investor behaviour. They're like slow-moving but powerful, suitable for long-term portfolios.

Here are a few current macrotrends we should be watching:

1. Demographic Shifts

Aging population in developed countries → impacts healthcare, pensions, real estate, and bond yields.

Emerging markets with a young population → potential for growth in consumption, innovation, and urban development.

2. Deglobalization & Geopolitical Fragmentation

Supply chain reconfiguration, regional alliances, tariffs, and nearshoring.

This creates opportunities in sectors such as logistics, defence, and local manufacturing, but also increases market volatility.

3. Climate Transition & Green Economy

Net-zero targets, ESG investments, renewables, and carbon markets.

Structural shifts in the energy, materials, and finance sectors → new opportunities, but also stranded asset risk.

4. Technological Acceleration

AI, automation, digital infrastructure, biotech.

Disruption across all sectors. Investors must be selective about winners vs. hype.

5. Inflation Regimes & Interest Rates

We're shifting from a world of 0% interest rates to one of structurally higher inflation expectations and potentially more volatile interest rate cycles.

Impacts bond pricing, equity valuation models, and real asset allocations.

Understanding Risk

Risk isn't just volatility — it's the possibility of a permanent loss of capital or failure to meet your goals.

Categories of Risk:

Market Risk – equity drawdowns, bond price shifts, currency fluctuations.

Inflation Risk – erosion of real purchasing power.

Interest Rate Risk – especially critical in fixed income investments.

Credit Risk – defaults in corporate or sovereign bonds.

Liquidity Risk – inability to exit a position without major price impact.

Geopolitical/Regulatory Risk – sanctions, wars, policy changes.

Behavioural Risk – emotional investing, overconfidence, herd behaviour.

How We Link Macrotrends to Your Investment Risk Strategy

Diversification across geographies, asset classes, and currencies to mitigate concentration risk.

Risk-adjusted return focus: it's not about maximising returns, but about achieving optimal returns for your personal risk profile.

Bond ladders or barbell strategies in rising rate environments.

Tactical vs. Strategic Allocation: we may tactically reduce exposure in overheated sectors while sticking to a long-term core strategy.

Hedging: Currency exposure, gold, or options — depending on portfolio size and risk appetite.

Sustainability Lens: we consider ESG risk not as an ethical choice, but as a risk management tool.

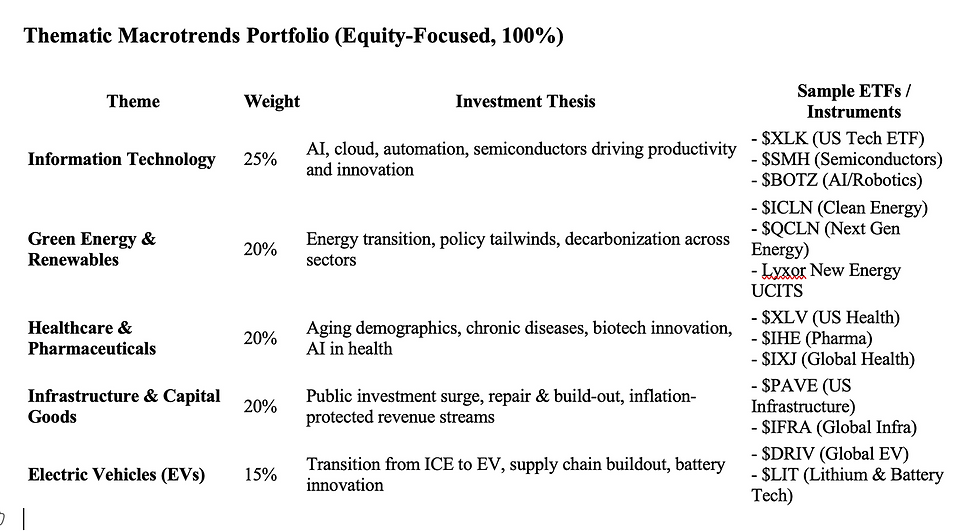

Let's have a scholastic example. Here is a possible investment case:

From the macrotrends reported in the previous table, let's build a portfolio:

And analyse it using the Markowitz model:

What can I expect from a risk perspective?

Disclaimer:

The content shared in this article is for informational and educational purposes only and does not constitute financial advice. Every investor has different goals, risk tolerance, and timelines, and no single portfolio is suitable for all. If you’re ready to move beyond financial guesswork and start building a personalised investment strategy, we invite you to explore our courses at: www.bankingadvisory.hu

Comments